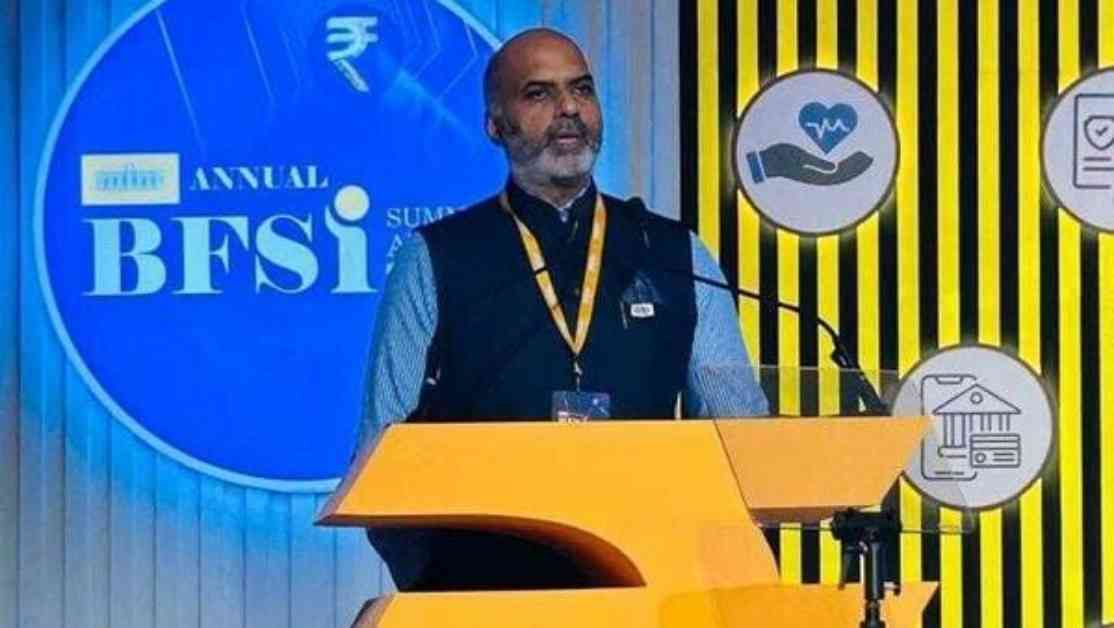

Sriram Iyer, HDFC Pension CEO, Challenges NPS Myths at BFSI Summit

At the recent Mint Annual BFSI Summit, Sriram Iyer, the chief executive of HDFC Pension Management, shed light on the prevailing myths surrounding the National Pension System (NPS) in India. Despite the growing interest in financial assets among Indians, there is still a significant gap in retirement planning, according to Iyer. Here’s a breakdown of his key points:

NPS: A Hidden Gem in Financial Planning

Iyer emphasized that while many view the NPS as offering mediocre returns, the reality is quite the opposite. The equity scheme under the NPS has outperformed average large-cap funds, delivering attractive returns over the long term. Moreover, the NPS’s corporate funds and government bond funds have consistently yielded over 7.5% returns, making it a compelling option for retirement planning.

Tax Benefits and Flexibility of NPS

Contrary to popular belief, the NPS offers significant tax benefits at various stages of investment. Under the new tax regime, individuals can claim up to 14% of their basic pay plus dearness allowance by investing in the NPS. Additionally, there is a separate ₹50,000 deduction available under Section 80CCD(1B) for NPS contributions, providing additional tax savings.

The Illiquidity Advantage of NPS

One of the unique features of the NPS is its restriction on full withdrawal until the age of 60, making it an illiquid investment. Iyer pointed out that this illiquid nature actually works in favor of subscribers, encouraging them to stay invested for the long term and potentially earn higher returns. By limiting premature withdrawals, the NPS promotes disciplined saving and long-term wealth creation.

In conclusion, Sriram Iyer’s insights at the BFSI Summit challenge common misconceptions about the NPS and highlight its potential as a powerful tool for retirement planning. By debunking myths, clarifying tax benefits, and emphasizing the advantages of long-term investment, Iyer’s message resonates with individuals seeking to secure their financial future through prudent retirement planning.